Introduction

In the present day monetary panorama, in which credit score rankings customarily dictate one's access to obligatory financial substances, many people to find themselves struggling with poor credits. For those grappling with pretty undesirable credit score, the lookup plausible financial treatments is additionally daunting. However, rapid secured loans present a glimmer of desire. These loans, equipped via direct lenders, are certainly designed to support these who've faced credit challenges in the previous. This article goals to explore the intricacies of obtaining quick secured loans for individuals with somewhat horrific credit inside the UK.

Understanding Bad Credit

What Constitutes Bad Credit?

Bad credit score is mostly defined as a low credits score, characteristically below 580 on a scale that primarily stages from three hundred to 850. Factors contributing to poor credit score come with ignored bills, defaults on loans, financial disaster, and high bad credt secured loans debt-to-income ratios.

How is Your Credit Score Calculated?

Your credit score rating is calculated established on various elements:

- Payment records (35%) Amounts owed (30%) Length of credit heritage (15%) Types of credit used (10%) New credit score inquiries (10%)

Understanding those ingredients can empower you to take keep an eye on of your monetary future.

Exploring Fast Secured Loans

What Are Fast Secured Loans?

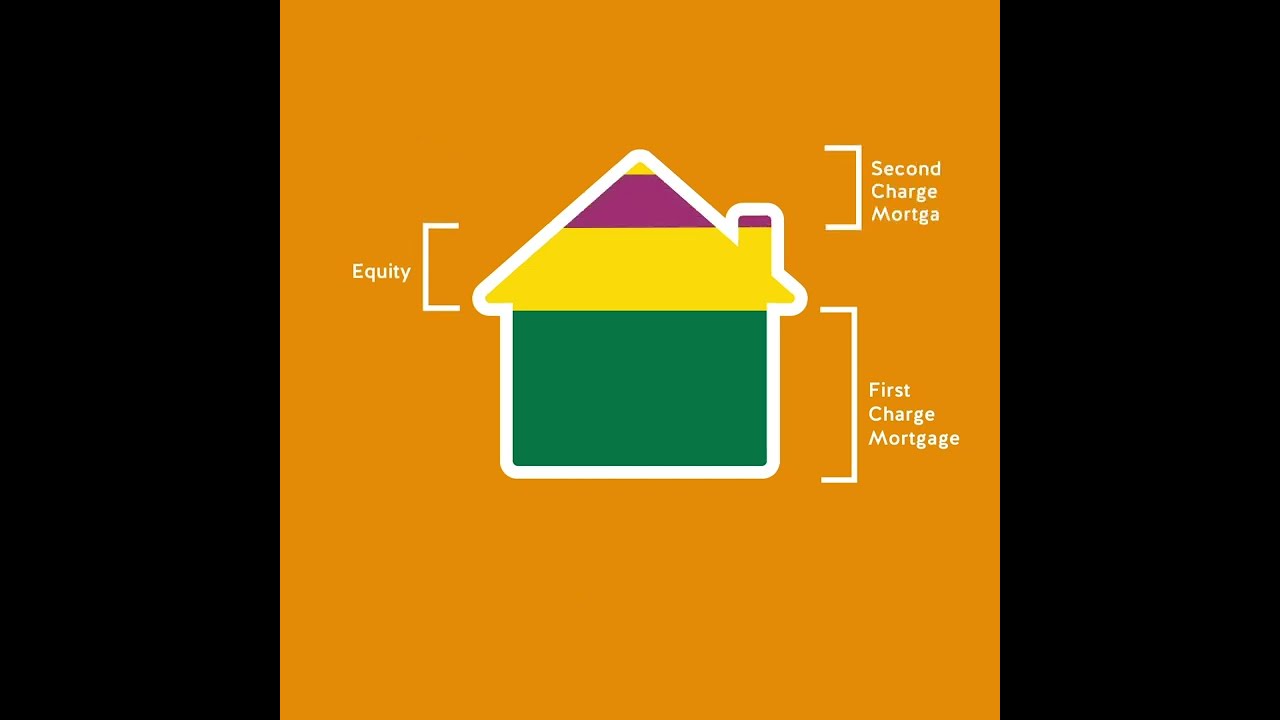

Fast secured loans are varieties of borrowing that require collateral—regularly estate or assets—to comfortable the loan quantity. They are designed for brief approval and disbursement, making them an captivating choice for the ones desiring fast income float.

Advantages of Fast Secured Loans

Quick Approval: Many lenders be offering instant processing instances. Lower Interest Rates: Collateral reduces risk for lenders, ultimate to cut down rates. Higher Loan Amounts: By securing your loan in opposition t an asset, you may also qualify for greater sums. Flexible Repayment Terms: Options differ through lender, enabling customization in response to your fiscal hindrance.Navigating the Loan Landscape in the UK

Loan Lenders UK Bad Credit Options

In the United Kingdom, a large number of lenders focus on proposing amenities to participants with much less-than-ideally suited credit score histories. These include common banks and choice finance organizations.

Types of Loan Lenders Available

High Street Banks: Although they will have stricter criteria. Credit Unions: Often more lenient and group-focused. Peer-to-Peer Lending Platforms: Connecting debtors rapidly with buyers. Online Direct Lenders: Quick functions and approvals with out intermediaries.Why Choose Loans Direct Lender for Bad Credit?

Direct creditors streamline the borrowing procedure with the aid of getting rid of brokers or third-celebration retailers. This outcomes in faster judgements and doubtlessly more desirable terms tailored to your certain crisis.

Loans for Bad Credit Direct Lenders Only

When searching for a loan, that's significant to work exclusively with direct lenders focusing on bad credits eventualities. This means minimizes pointless expenditures and maximizes transparency across the technique.

No Broker Loans for Bad Credit Instant Decision

Opting for no-broker loans method bypassing additional prices linked to middleman functions while offering you with instant judgements regarding loan approval.

The Application Process Explained

Step-by means of-Step Guide to Applying for Fast Secured Loans

Evaluate Your Financial Situation- Assess how lots you want and what collateral that you can provide.

- Compare hobby premiums and terms from assorted direct lenders that specialize in awful credit scenarios.

- Gather profit statements, proof of id, and particulars regarding your collateral.

- Provide accurate expertise to facilitate a swift software manner.

- Direct lenders primarily present swifter responses than average banks; anticipate a solution inside of hours or days.

- Carefully contemplate interest quotes and reimbursement terms prior to finalizing any settlement.

Factors Affecting Approval Rates for Secured Loans

Understanding What Influences Loan Decisions

Lenders reflect onconsideration on countless key components when assessing programs:

- The importance of collateral offered Your revenue balance Existing accounts Overall financial conditions

By comprehending these points, candidates can fortify their probabilities of approval with the aid of strategic making plans.

Interest Rates on Fast Secured Loans

How Are Interest Rates Determined?

Interest rates vary vastly primarily based on:

- The lender’s insurance policies The degree of threat related to your application Economic climate

Comparing bargains from extraordinary creditors may also help find a competitive cost that matches your desires.

Repayment Strategies for Borrowers With Bad Credit

**Creating a Manageable Repayment Plan **

A well-proposal-out repayment plan is relevant when managing quick secured loans properly:

Stick to a budget that prioritizes personal loan repayments. Consider automated funds to steer clear of late quotes. Maintain open verbal exchange along with your lender if difficulties rise up.**Alternatives to Fast Secured Loans **

For a few men and women going through intense monetary constraints or negative lending prerequisites:

Peer-to-peer lending platforms may want to grant aggressive chances. Government offers or aid classes can be purchasable based on occasions. Personal traces of credit score as versatile choices may perhaps support meet pressing salary wishes without collateral requirements.**Common Misconceptions About Secured Loans **

There are everyday myths surrounding secured loans that want rationalization:

High-hazard borrowers cannot obtain secured loans—this will never be entirely accurate; it relies upon on selected lender guidelines. All secured loans come with exorbitant activity premiums—examine finds competitive thoughts exist even amongst those with negative credits rankings. three .Secured loans lead instantly into foreclosures—this takes place merely if borrowers default with no communicating concerns timely with their lender .**Risks Involved With Fast Secured Loans **

While there are merits associated with swift secured loans , debtors need to additionally be aware viable risks : 1 .Collateral loss if repayments fail perpetually over time . 2 .Potential destructive influence on ordinary debt-to-salary ratio depending upon overall outstanding responsibilities . 3 .The danger that predatory lending practices ought to emerge from targeted less-respected carriers .

**FAQs about Fast Secured Loans for Those With Really Bad Credit **

Here are some in the main asked questions referring to quick secured loans:

1 . Can I get a quick secured personal loan if I even have actually terrible credit score? Yes! Many direct lenders specialize above all in supporting purchasers like yourself who possess tough finances .

2 . What kinds of collateral can I use? Common varieties embody true property properties , autos , or different powerful belongings that continue substantial worth .

three . How at once will I accept money after approval? Most direct lending establishments promise investment turnaround inside of simply hours put up-finalization relying upon their exceptional policies .

four . Will utilizing influence my credits rating negatively ? Generally communicating , utilising simply by assorted resources without ok lookup may well bring about minor dips but focusing fully upon one legitimate provider minimizes this probability considerably .

5 . Are there hidden charges related ? Reputable agencies ought to furnish clear outlines detailing all desirable prices prematurely prior signing any agreements guaranteeing transparency for the time of tactics involved .

6 . Can I pay off my mortgage early devoid of penalty ? Policies range broadly structured upon chosen creditors ; accordingly evaluating contracts carefully prior committing helps clarify this detail previously avoiding surprises later down street ahead !

**Conclusion **

Unlocking Financial Freedom: Fast Secured Loans for Those with Really Bad Credit – Direct Lenders within the UK offers renewed hope amidst not easy situations confronted by many lately dealing with damaging financial realities surrounding private finance control procedures at present attainable globally! By knowledge equally strategies provided right here along practicable pitfalls in contact conscientiously gaining knowledge of applicable candidates inclined collaborate along their prospects’ excellent pastimes ; humans suffering financially ExpressFinance Putney reap access integral resources needed toward rebuilding pathways optimal in the direction of extended universal livelihood long-time period sustainability!

This article has been crafted following search engine optimisation principles while conserving rich content material bad credt secured loans relevantly established utilizing suitable headings designed optimize user experience throughout alternative units making sure gentle navigation at some point of overall piece seamlessly incorporated at the same time providing comprehensive insights mandatory when exploring probably avenues address extraordinary cases encountered within realms dealing peculiarly around securing payments regardless old reviews encountered along approach!